montana sales tax rate change

38 This is the first of six incremental reductions that will ultimately reduce the rate to 399 percent by tax year 2027. Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax.

Vehicle owners to register their cars in Montana.

. The 2022 state personal income tax brackets are updated from the Montana and Tax Foundation data. Indiana has the lone corporate income tax rate change with the rate decreasing from 525 to 49 percent. Thirteen states have notable tax changes taking effect July 1 2021.

All Businesses Cannabis Control Individuals Licenses Property Tobacco and Nicotine. Montana tax forms are sourced from the Montana income tax forms page and are updated on a yearly basis. And Friday 900 am.

On average Montanans paid 395 per capita in residential taxes in 2002 and 806 in 2018 an increase of more than 100. Consumer Counsel Fee CCT Consumer Counsel Fee CCT Contractors 1 Gross Receipts Tax CGR Contractors 1 Gross Receipts Tax CGR Emergency Telephone System Fee. 4214101 ARM through 4214112 ARM and a 3 lodging facility sales tax see 15-68-101 MCA through 15-68-820 MCA for a combined 7 lodging facility sales and use tax.

Combined with the state sales tax the highest sales tax rate in Montana is 5 in the cities of Sidney Fairview Westby and Biddle. Montana state sales tax rate. The minimum combined 2022 sales tax rate for Billings Montana is.

Montana will begin using a corporate income tax apportionment formula with a double-weighted sales factor. Senate Bill 159 passed during the 67th Montana Legislative Session reduced the highest marginal tax rate for individuals estates trusts and pass-through entities. While the base rate applies statewide its only a starting point for calculating sales tax in Montana.

Gianforte signed another companion bill that cuts taxes for the top marginal tax rates from 69 to 675 in 2022 and then to 65 in 2024. This reduction begins with the 2022 tax year. Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to other states that may have registration fees sales tax and local taxes is significantly lower.

Average Sales Tax With Local. Under provisions of North Carolinas biennial budget bill signed by Governor Roy Cooper D on November 18 2021 the states flat income tax rate was reduced to 499 percent on January 1 2022. Montanas tax rate for a statewide sales tax is limited to 4 percent in the state constitution.

This means that depending on your location within Montana the total tax you pay can be significantly higher than the 0 state sales tax. If you need help working with the department or figuring out our audit appeals or relief processes the Taxpayer Advocate can help. As Montana grapples with a state budget crisis lawmakers and the public are asking questions about a sales tax and debating whether to consider enacting a statewide sales tax in Montana.

Maxwell James Jared Walczak. States without a sales tax include Alaska Delaware New Hampshire Montana and Oregon. Local sales taxes can increase the sales tax rates of some areas above their statewide level with combined rates that can exceed 10 percent.

Montana local resort areas and communities are authorized. For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. The Montana sales tax rate is currently.

Including local taxes the Montana use tax can be as high as 0000. The Montana use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Montana from a state with a lower sales tax rate. Base state sales tax rate 0.

Ad Get tax compliance information for the US. The Montana use tax rate is 0 the same as the regular Montana sales tax. Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned legislative session enacting three bills reducing individual tax rates simplifying the states individual tax system repealing 16 tax credits and changing the apportionment factor for corporate income tax.

Montana currently has seven marginal tax rates. Montana Sales Tax Table at 0 - Prices from 100 to 4780. Idaho will offer a one-time individual income tax.

Print This Table Next Table starting at 4780 Price Tax. The brackets will decrease from seven to two and the new rates will be 47 and 65. Dakota 5 percent in North Dakota and 6 percent in Idaho.

However the state does impose a tax on sales of medical marijuana products a sales and use tax on accommodations and campgrounds a lodging facility use tax and a limited sales and use tax on the base rental charge for rental vehicles. The highest tax rate will decrease from 69 to 675 on any taxable income over 19800. Residential property tax collections have risen on a per capita basis faster than inflation over the past 16 years in 53 of Montanas 56 counties according to a Montana Free Press analysis of the tax study data.

The tax applies to charges paid for the use of. There are a total of 73 local tax jurisdictions across the state collecting an average local tax of 0002. Taxpayers will use the federal filing status to determine their tax rate much like how tax is calculated federally.

Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets. The bill will eliminate 23 tax credits in the process. Lastly Montana taxpayers will see a reduction in the number of tax brackets and a decrease in the tax rate.

Cutting income taxes was a top goal for the governor this legislative session as part his Comeback Plan aimed at boosting the states economy. Montana has no state sales tax and allows local governments to collect a local option sales tax of up to 1. The County sales tax rate is.

This is the total of state county and city sales tax rates. Learn about new tax laws some long-term effects of recent events industry updates. Montana has no state sales tax and.

Wayfair Inc affect Montana. The Billings sales tax rate is. Montana does not impose a state-wide sales tax.

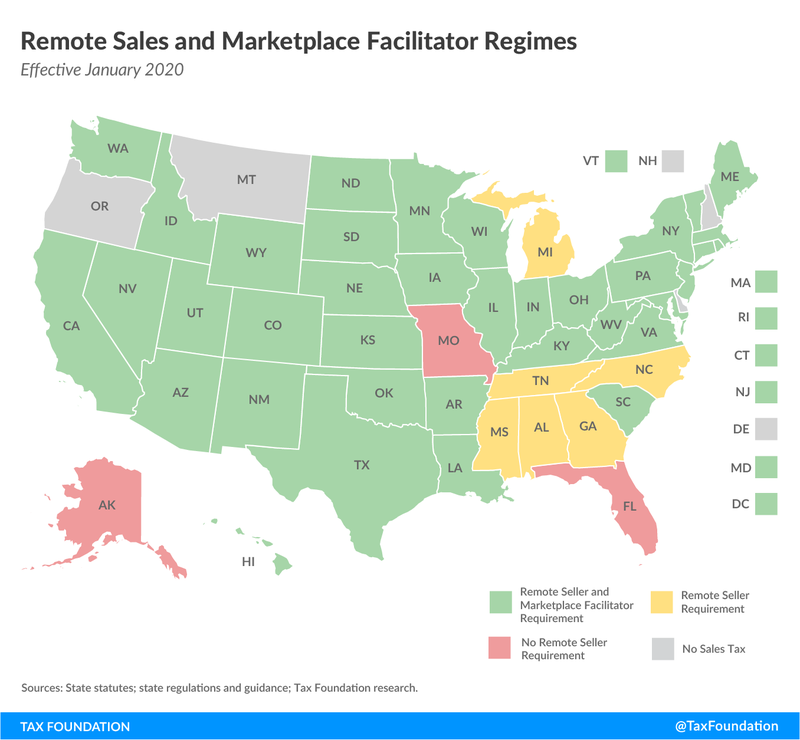

Did South Dakota v. And around the globe from Avalara experts. Were available Monday through Thursday 900 am.

Montana is one of only a handful of states that does not impose a statewide sales tax.

States With Highest And Lowest Sales Tax Rates

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

State Income Tax Rates Highest Lowest 2021 Changes

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

Car Sales Tax In Montana Getjerry Com

States Without Sales Tax Article

States Without Sales Tax Article

Montana Sales Tax Rates By City County 2022

A Small Business Guide To E Commerce Sales Tax The Blueprint

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States Without Sales Tax Article

Ci 121 Montana S Big Property Tax Initiative Explained